Trend Precognition Indicators

Spot Micro Trend Reversals on Any Asset

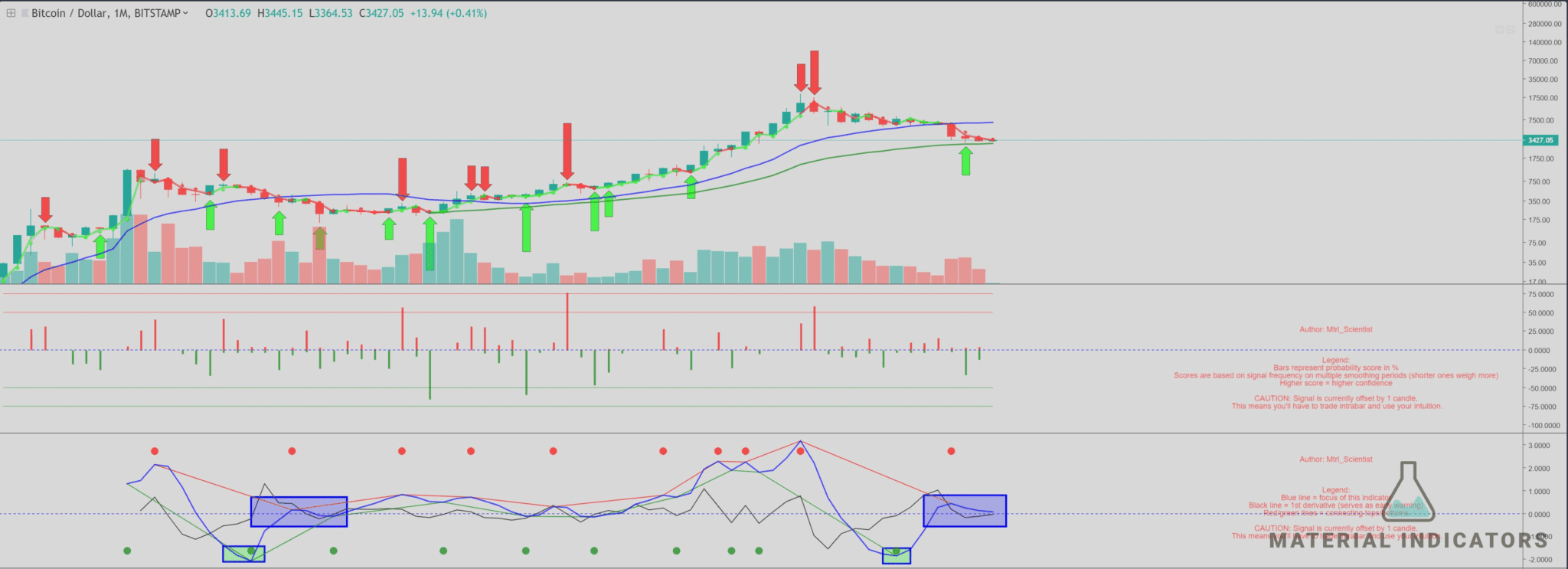

With default settings optimized for longer timeframes, our Trend Precognition indicator includes a set of on and off chart predictive algorithmic trading indicators which may be optimized relative to any time frames you choose. This will help you execute winning Long and Short strategies.

*Requires a TradingView account.

See The Market As It Is and Spot Micro Trend Reversals

We’ve found that users of our trading indicators and signals are using Trend Precognition to validate the moves they want to make. Whatever time frame that you like to trade, and regardless of whether your strategy is Long or Short, Trend Precognition can help you validate the current micro trend and signal potential reversals. Like any trading tool, nothing is guaranteed, but when combined with a high performance indicator like MTF and our #FireCharts, it provides data on the micro trend that can help you make trading decisions on the fly, giving you the edge you need, regardless of market conditions.

Multiple Configuration Options to Fit Your Strategies

With default settings optimized for longer timeframes, our Trend Precognition indicator includes a set of on and off chart predictive algorithmic trading indicators which may be optimized to point out probable micro trend reversals relative to Long and Short strategies for any time frame you choose. With a multitude of configuration options, Trend Precognition becomes the trend analysis tool you need to fit how you trade. No more having to fit your strategy to a tool. Precisely configure it based on what you need to make the best decisions about your trades.

Pick the Algorithms That Work For You

Trend Precognition is an algorithmic trading indicator that includes on and off chart tools to help predict probable micro trend reversals. Choose from one of 3 algorithms to work within your trading preferences and then use configuration options for each algorithm to optimize for the specific time frames and strategies you use. Do you want more assurance that a trend is locked in, then use higher probability thresholds. Want to see a trend earlier, but risk that it isn’t quite baked into the overall market, then adjust the probability % down. By giving you the flexibility to adjust the indicator, you can optimize it for any strategy you use.

Subscribe to our newsletter

Get news, updates, and offers from Material Indicators

Thank you!

You have successfully joined our subscriber list.